Frequently asked questions

When it comes to making a financial decision, it's important to ask questions. Here are the answers to some of your most common ones.

For Account Owners

Read our how-tosMost common Edvest 529 questions

Qualified higher education expenses include tuition, certain room and board expenses, fees, books, supplies and equipment required for the enrollment and attendance of the beneficiary at an eligible educational institution. This includes most postsecondary institutions. When used primarily by the beneficiary enrolled at an eligible educational institution, computers and related technology such as internet access fees, software or printers are also considered qualified higher education expenses.

Qualified higher education expenses also include certain additional enrollment and attendance costs at eligible educational institutions for any beneficiary with special needs.

At the federal level, qualified higher education expenses also include:

- Qualified K-12 expenses at a public, private or religious school (up to a maximum of $10,000 of distributions per taxable year per beneficiary from all Section 529 plans)1. The limit will increase to $20,000 beginning January 1, 2026;

- Expenses for fees, books, supplies an equipment required for the participation of a beneficiary in a certified apprenticeship program1;

- Recognized postsecondary credential programs; and

- Amounts paid as principal or interest on any qualified education loan of either the beneficiary or a sibling of the beneficiary (up to a lifetime limit of $10,000 per individual)1.

For more information on using 529s for apprenticeships, click here.

Footnotes

- 1Withdrawals for qualified expenses at a public, private or religious elementary, middle, or high school, registered apprenticeship programs, recognized credential programs, and student loans can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

Wisconsin taxpayers are eligible for a state income tax deduction for contributions to the Edvest 529 College Savings Plan. The maximum deduction on contributions made to an Edvest 529 account for the 2025 tax year is:

- $5,130 per Beneficiary for single filers or married couples filing a joint return; or

- $2,560 per Beneficiary for married couples filing separate.

The Wisconsin state income tax deduction for contributions made to a Wisconsin 529 plan is available to any Wisconsin taxpayer, not just the 529 plan account owner, making gift contributions a benefit for family members or friends.

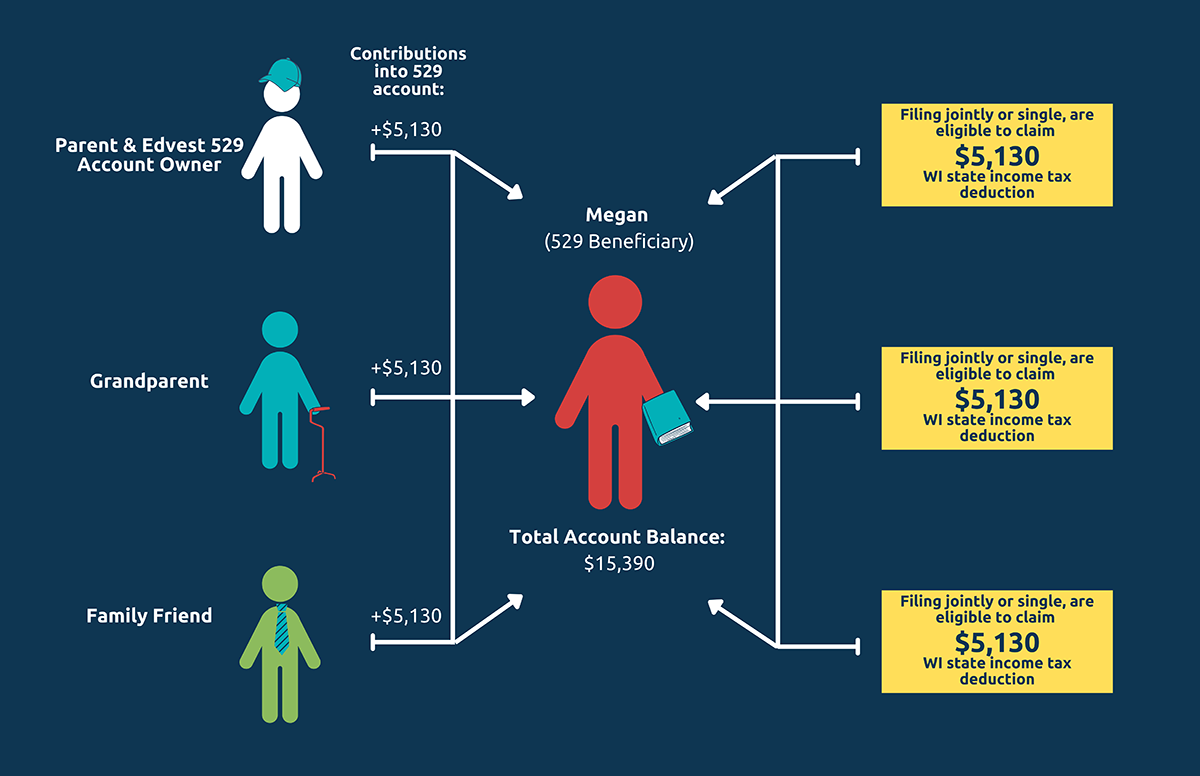

Example 1: Multiple Contributors

The Edvest Account Owner (Parent) contributes $5,130 to their child's (Megan's) account, a Grandparent also contributes $5,130 to Megan's account, and a family friend also contributes $5,130 to Megan's account during the 2025 tax year – the parent, grandparent, and family-friend are eligible to claim the $5,130 Wisconsin state tax deduction on their 2025 Wisconsin state incomes taxes (if their filing status is married filing joint or single).

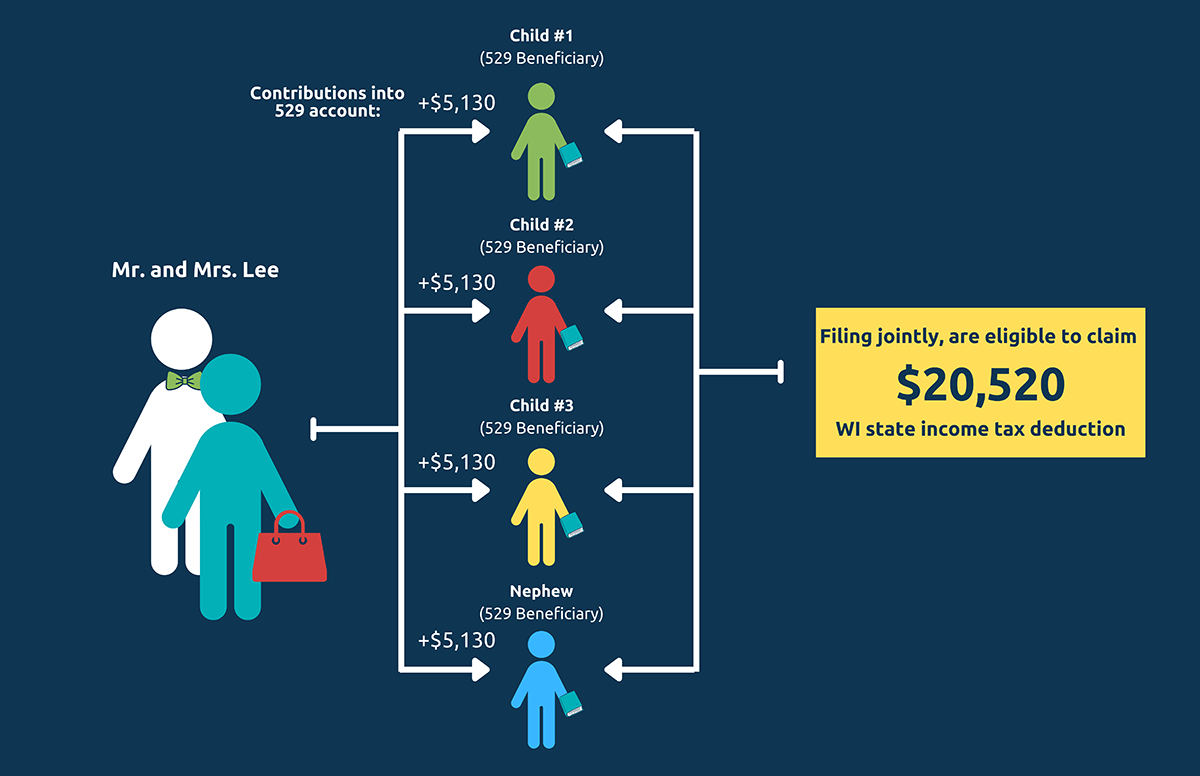

Example 2: Multiple Beneficiaries

Mr. & Mrs. Lee have Edvest 529 accounts for their 3 children and contribute $5,130 to each child's account ($15,390 total). They also make a $5,130 gift contribution to their nephew's account. When filing their Wisconsin state income taxes, as married filing jointly, are eligible to claim a deduction of $20,520 from their income.

A Wisconsin taxpayer is permitted a deduction from Wisconsin adjusted gross income for a contribution to an account less any Qualified Withdrawals made during the tax year. Rollovers of the principal amount into an Edvest 529 account are eligible for the subtraction from state taxable income, subject to applicable yearly limitations. Amounts in excess of the current tax year's deduction limit may be carried forward to future years and claimed as a subtraction subject to the yearly limitations. Wisconsin taxpayers should be aware that the Wisconsin 529 College Savings Program requires the use of a "first in, first out" method of accounting. Any withdrawals taken from a 529 account within 365 days of being contributed, or carried forward, must be added back to the filer's taxable income for state tax purposes.

With your Edvest 529 account, you're never locked in. You’ll always have access to several options for this money:

- Your funds can be used to pay for a variety of eligible education expenses, including at any accredited college, university, apprenticeships, community college or postgraduate program in the United States—and even some schools abroad.1

- Your 529 can be used for student loan repayment up a $10,000 lifetime limit per individual.1

- Pay for qualified K-12 expenses - up to $10,000 annually can be used per student at a public, private or religious elementary, middle or high school for qualified expenses. Qualified education expenses include curriculum, instructional materials, tutoring by approved professionals, standardized test and dual enrollment fees, and licensed educational therapies for students with disabilities.1 Click here for more information on the recent changes to primary or secondary school qualified expenses.

- You can transfer the funds to another eligible beneficiary, such as another child, a grandchild or yourself.

- If you just want the money back, you can withdraw the funds at any time. If funds are withdrawn for a purpose other than qualified higher education expenses, the earnings portion of the withdrawal is subject to federal and state taxes plus a 10% additional federal tax on earnings (known as the "Additional Tax"). See the Plan Description for more information and exceptions.

- Effective January 1, 2024, Account owners may roll money from an Edvest 529 account to a Roth IRA for the benefit of the 529 plan account beneficiary without incurring federal income tax or penalties (state tax treatment varies). For the rollover to be treated as a non-taxable event, certain conditions apply as referenced in Am I eligible to roll over funds from my 529 plan account to a Roth IRA?

- You can use funds for recognized postsecondary credentials and credential program fees. Click here for more information on the recent changes to qualified expenses.

- Or you can always wait because the funds never expire, and often the choice to go to school is a delayed decision. So, if your child changes their mind down the road, your account will still be available.

Footnotes

- 1Withdrawals for qualified expenses at a public, private or religious elementary, middle, or high school, registered apprenticeship programs, and student loans can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

There's no cost associated with opening an Edvest 529 account or owning more than one account. You could open a different account for each child.

You might do this to align investment strategies with the time frame each child will begin using the funds. For example, an older child's account could be more conservatively invested to help protect your contributions as they near college, whereas a younger child's account might be invested to balance growth and income strategies during a longer time frame. You may also prefer to pay college expenses first out of your highest growth account to maximize federal tax benefits and to encourage gift contributions from friends and family.

Keep in mind: Edvest 529 allows you the flexibility to select multiple investment portfolios within each account. This offers you more control to manage risk on your terms. For example, adding the Principal Plus Interest Investment Portfolio can help preserve your funds until your student is ready for the next step in their education.

Multiple accounts can also aid in estate planning by ensuring that college funds are allocated appropriately to each beneficiary upon the death of the account owner. But if you'd like to stick to one account, you can change beneficiaries at any time and at no additional cost.

No. Your Edvest 529 funds can be used at any accredited university in the country—and even some abroad. This includes public and private colleges and universities, apprenticeships, community colleges, graduate schools and professional schools. Up to $10,000 annually can be used toward K-12 qualified expenses (per student). In addition, your 529 can be used for student loan repayment up a $10,000 lifetime limit per individual.1 Review a list of qualifying expenses and the state tax treatment of withdrawals for these expenses in the Plan Description.

Footnotes

- 1Withdrawals for qualified expenses at a public, private or religious elementary, middle, or high school, registered apprenticeship programs, and student loans can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

Your contributions will always be yours, and you do not need to be a resident of Wisconsin to open, contribute to or use an Edvest 529 account. Your Edvest 529 account can also be used for a range of qualified expenses in state, out of state and abroad. If you move to another state, you can keep your money invested and continue making contributions to your Edvest 529 account—no problem!

The beneficiary must be enrolled at least half-time at an eligible postsecondary institution. For students living in housing owned and operated by the institution, the full invoice amount will be used to determine the qualified housing and food expenses. In the case of students living at home or in off-campus housing, the "cost of attendance" allowance for the individual institution will be used for the qualified room and board expenses.

For Account Owners

Read our how-tosAll Frequently Asked Questions

About 529 plans

A 529 plan is a tax-advantaged savings plan designed to help families save for college and a range of other qualified education expenses. 529 refers to Section 529 of the Internal Revenue Code. Read more here: Benefits of a 529

Edvest 529 provides a unique set of benefits that can mean more flexibility and growth potential, including:

- Tax-free qualified withdrawals

- Wisconsin state tax deduction

- Low fees and expenses

- Easy-to-choose investment portfolios

- Favorable financial aid treatment

- Use for a wide range of education expenses and programs—in Wisconsin and around the world

Get more details and compare savings options.

With your Edvest 529 account, you're never locked in. You’ll always have access to several options for this money:

- Your funds can be used to pay for a variety of eligible education expenses, including at any accredited college, university, apprenticeships, community college or postgraduate program in the United States—and even some schools abroad.1

- Your 529 can be used for student loan repayment up a $10,000 lifetime limit per individual.1

- Pay for qualified K-12 expenses - up to $10,000 annually can be used per student at a public, private or religious elementary, middle or high school for qualified expenses. Qualified education expenses include curriculum, instructional materials, tutoring by approved professionals, standardized test and dual enrollment fees, and licensed educational therapies for students with disabilities.1 Click here for more information on the recent changes to primary or secondary school qualified expenses.

- You can transfer the funds to another eligible beneficiary, such as another child, a grandchild or yourself.

- If you just want the money back, you can withdraw the funds at any time. If funds are withdrawn for a purpose other than qualified higher education expenses, the earnings portion of the withdrawal is subject to federal and state taxes plus a 10% additional federal tax on earnings (known as the "Additional Tax"). See the Plan Description for more information and exceptions.

- Effective January 1, 2024, Account owners may roll money from an Edvest 529 account to a Roth IRA for the benefit of the 529 plan account beneficiary without incurring federal income tax or penalties (state tax treatment varies). For the rollover to be treated as a non-taxable event, certain conditions apply as referenced in Am I eligible to roll over funds from my 529 plan account to a Roth IRA?

- You can use funds for recognized postsecondary credentials and credential program fees. Click here for more information on the recent changes to qualified expenses.

- Or you can always wait because the funds never expire, and often the choice to go to school is a delayed decision. So, if your child changes their mind down the road, your account will still be available.

Footnotes

- 1Withdrawals for qualified expenses at a public, private or religious elementary, middle, or high school, registered apprenticeship programs, and student loans can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

Your contributions will always be yours, and you do not need to be a resident of Wisconsin to open, contribute to or use an Edvest 529 account. Your Edvest 529 account can also be used for a range of qualified expenses in state, out of state and abroad. If you move to another state, you can keep your money invested and continue making contributions to your Edvest 529 account—no problem!

No. Your Edvest 529 funds can be used at any accredited university in the country—and even some abroad. This includes public and private colleges and universities, apprenticeships, community colleges, graduate schools and professional schools. Up to $10,000 annually can be used toward K-12 qualified expenses (per student). In addition, your 529 can be used for student loan repayment up a $10,000 lifetime limit per individual.1 Review a list of qualifying expenses and the state tax treatment of withdrawals for these expenses in the Plan Description.

Footnotes

- 1Withdrawals for qualified expenses at a public, private or religious elementary, middle, or high school, registered apprenticeship programs, and student loans can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

529 plans can vary in a number of ways. Edvest 529 offers a variety of benefits including:

- Tax-free qualified withdrawals

- Wisconsin state tax deduction

- Low fees

- Funds may be used for all eligible expenses

- Family and friends can gift

- Open an account with as little as $25

A Wisconsin state plan has been the preferred choice for thousands of families for more than 25 years. With an established history, Edvest 529 has helped more than 238,000 students and families save more than $5.6 billion toward education.1 The Wisconsin Department of Financial Institutions selected TIAA-CREF Tuition Financing, Inc. (TFI) as the Direct Plan Manager.

- 1Based on statistics provided as of 12/31/2024.↩

Tax considerations for an Edvest 529 account

Edvest 529 account owners can benefit from three types of tax advantages:

- Wisconsin State Income Tax Deduction - Wisconsin taxpayers are eligible for a state income tax deduction for contributions to the Edvest 529 College Savings Plan.

- Tax-deferred growth - With an Edvest 529 account, if your money grows over time through investment earnings, unlike some other investment account, you will not be taxed on the growth (earning portions) while the funds are in the account.

- Tax-free withdrawals for qualified educational expenses - Unlike taxable investment accounts, if you use your funds to pay for qualified higher education expenses, then you do not have to pay state or federal taxes on the earnings at all.

Learn more about Edvest 529's tax benefits.

If you don't use your funds on qualified expenses – only the earnings portion withdrawn is subject to state and federal income tax, as well as a 10% federal tax penalty. The contribution portion of your account will never be taxed or penalized since it was made with after-tax dollars.

Additionally, there are instances in which the 10% tax penalty does not apply, such as the death or disability of the beneficiary and the receipt of a qualified scholarship by the beneficiary.

So remember - the unique tax advantages of saving with Edvest 529 include the Wisconsin state income tax deduction, tax-deferred growth, and tax-free withdrawals for qualified educational expenses.

Wisconsin taxpayers are eligible for a state income tax deduction for contributions to the Edvest 529 College Savings Plan. The maximum deduction on contributions made to an Edvest 529 account for the 2025 tax year is:

- $5,130 per Beneficiary for single filers or married couples filing a joint return; or

- $2,560 per Beneficiary for married couples filing separate.

The Wisconsin state income tax deduction for contributions made to a Wisconsin 529 plan is available to any Wisconsin taxpayer, not just the 529 plan account owner, making gift contributions a benefit for family members or friends.

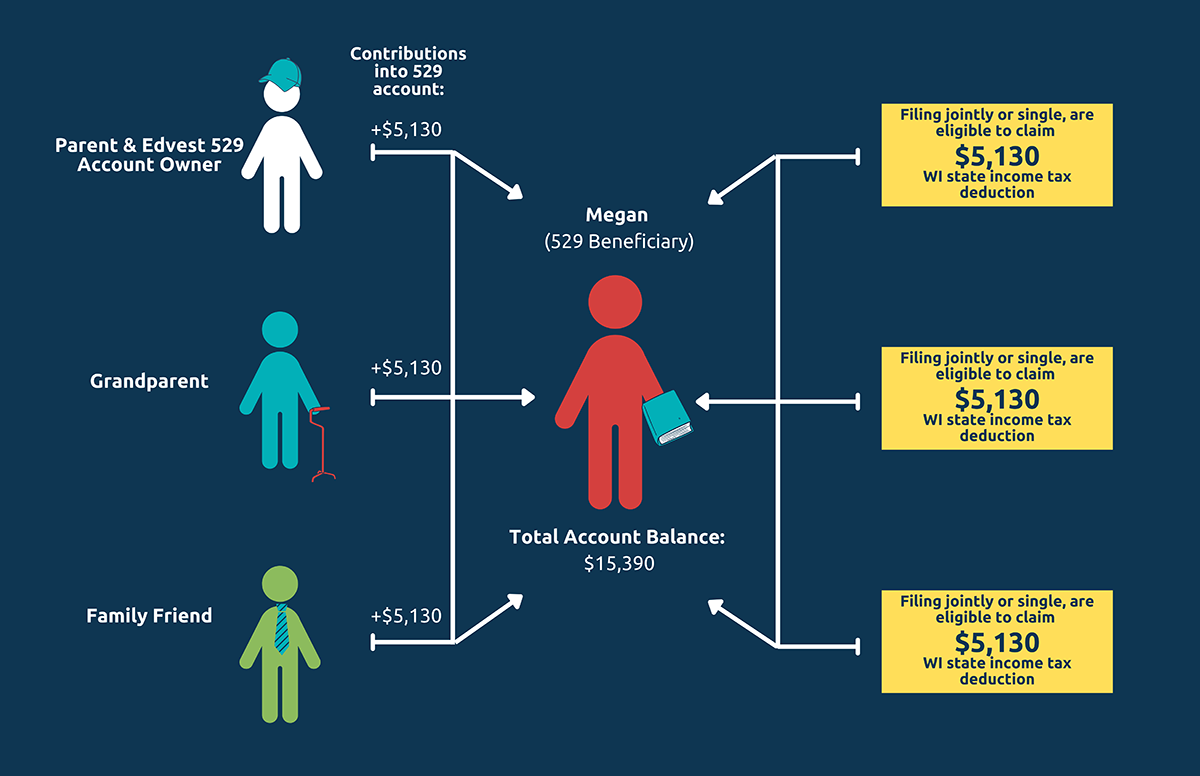

Example 1: Multiple Contributors

The Edvest Account Owner (Parent) contributes $5,130 to their child's (Megan's) account, a Grandparent also contributes $5,130 to Megan's account, and a family friend also contributes $5,130 to Megan's account during the 2025 tax year – the parent, grandparent, and family-friend are eligible to claim the $5,130 Wisconsin state tax deduction on their 2025 Wisconsin state incomes taxes (if their filing status is married filing joint or single).

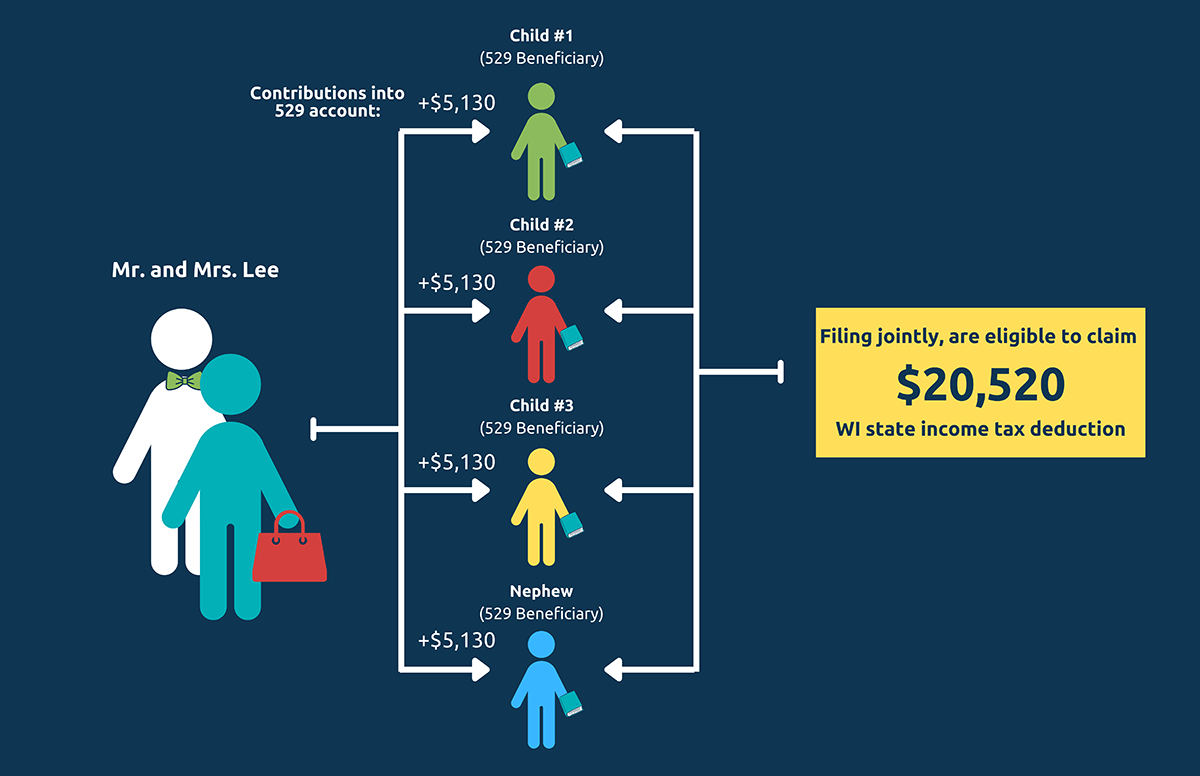

Example 2: Multiple Beneficiaries

Mr. & Mrs. Lee have Edvest 529 accounts for their 3 children and contribute $5,130 to each child's account ($15,390 total). They also make a $5,130 gift contribution to their nephew's account. When filing their Wisconsin state income taxes, as married filing jointly, are eligible to claim a deduction of $20,520 from their income.

A Wisconsin taxpayer is permitted a deduction from Wisconsin adjusted gross income for a contribution to an account less any Qualified Withdrawals made during the tax year. Rollovers of the principal amount into an Edvest 529 account are eligible for the subtraction from state taxable income, subject to applicable yearly limitations. Amounts in excess of the current tax year's deduction limit may be carried forward to future years and claimed as a subtraction subject to the yearly limitations. Wisconsin taxpayers should be aware that the Wisconsin 529 College Savings Program requires the use of a "first in, first out" method of accounting. Any withdrawals taken from a 529 account within 365 days of being contributed, or carried forward, must be added back to the filer's taxable income for state tax purposes.

No. If you are making a withdrawal to cover a qualified education expense for the beneficiary, you are not subject to federal or state income tax.

Qualified education expenses such as tuition, certain room and board expenses, fees, books, supplies, computers and equipment required for the enrollment and attendance of the beneficiary at an eligible educational institution, which includes most postsecondary institutions. Review the Plan Description for additional details on eligible expenses and withdrawals.

The earnings portion of a non-qualified withdrawal is subject to federal and state income taxation and an additional 10% federal tax. See the Plan Description for details.

The available federal tax benefits for paying qualified education expenses through these plans must be coordinated to avoid the duplication of such benefits. Account owners should consult a qualified tax advisor regarding the interaction under the Internal Revenue Code (IRC) of the federal income tax education-incentive provisions when addressing account withdrawals.

Contributions to an Edvest 529 account may help reduce the taxable value of your estate. Learn more about gifting to an existing account. For additional details on tax benefits, we recommend consulting a tax advisor.

There is no federal income tax deduction for 529 plan contributions, regardless of where you live or which 529 plan you participate in.

Plan contributions are always made after-tax.

At the federal level, qualified rollovers from a 529 plan account to a Roth IRA do not incur federal income tax or penalties.

State tax treatment of a rollover from a 529 plan into a Roth IRA is determined by the state where you file state income tax.

For Wisconsin taxpayers, a rollover from a 529 plan account to a Roth IRA is permitted without incurring federal or Wisconsin income tax or penalties.

For the rollover to be treated as a non-taxable event, the following conditions apply:

- The Account must have been open for 15 or more years, ending with the date of the rollover;

- Contributions and associated earnings that you transfer to the Roth IRA must have been in the Account for more than 5 years, ending with the date of the rollover;

- The rollover does not exceed the lifetime maximum amount of $35,000 per designated beneficiary to be rolled over from 529 plan accounts to Roth IRAs;

- The rollover is into a Roth IRA maintained for the benefit of the Beneficiary on the Account; and

- The rollover is sent directly to the Roth IRA.

Please note that Roth IRA income limitations are waived for 529 plan rollovers to Roth IRAs; however, a Roth IRA contribution is subject to the Roth IRA contribution limit for the taxable year applicable to the Beneficiary for all individual retirement plans maintained for the benefit of the Beneficiary.

The IRS is expected to issue additional guidance that may impact 529 plan account rollovers to Roth IRAs, including the above referenced conditions.

State tax treatment of a rollover from a 529 plan into a Roth IRA is determined by the state where you file state income tax. Account Owners and Beneficiaries should consult with a qualified tax professional before rolling over funds from their 529 plan to contribute to a Roth IRA. You are responsible for determining the eligibility of a 529 plan to Roth IRA rollover including tracking and documenting the length of time the 529 plan account has been opened and the amount of assets in your 529 plan account eligible to be rolled into a Roth IRA.

Eligible expenses and withdrawals

Qualified higher education expenses include tuition, certain room and board expenses, fees, books, supplies and equipment required for the enrollment and attendance of the beneficiary at an eligible educational institution. This includes most postsecondary institutions. When used primarily by the beneficiary enrolled at an eligible educational institution, computers and related technology such as internet access fees, software or printers are also considered qualified higher education expenses.

Qualified higher education expenses also include certain additional enrollment and attendance costs at eligible educational institutions for any beneficiary with special needs.

At the federal level, qualified higher education expenses also include:

- Qualified K-12 expenses at a public, private or religious school (up to a maximum of $10,000 of distributions per taxable year per beneficiary from all Section 529 plans)1. The limit will increase to $20,000 beginning January 1, 2026;

- Expenses for fees, books, supplies an equipment required for the participation of a beneficiary in a certified apprenticeship program1;

- Recognized postsecondary credential programs; and

- Amounts paid as principal or interest on any qualified education loan of either the beneficiary or a sibling of the beneficiary (up to a lifetime limit of $10,000 per individual)1.

For more information on using 529s for apprenticeships, click here.

Footnotes

- 1Withdrawals for qualified expenses at a public, private or religious elementary, middle, or high school, registered apprenticeship programs, recognized credential programs, and student loans can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

A non-qualified withdrawal is any withdrawal that does not meet the requirements of being a (a) qualified withdrawal; (b) taxable withdrawal; or (c) rollover. The earnings portion of a non-qualified withdrawal is subject to state and federal income taxation and the 10% additional federal penalty tax on earnings (the "Additional Tax"). See the Plan Description for more info.

Your Edvest 529 account can be used at eligible colleges, universities, vocational schools, community colleges, graduate or postgraduate programs, apprenticeships and more.1 Contact your school to determine whether it qualifies as an eligible educational institution or use the Federal School Code Search tool on the Free Application for Federal Student Aid (FAFSA) website.

Footnotes

- 1Withdrawals for tuition expenses at a public, private or religious elementary, middle, or high school, registered apprenticeship programs, and student loans can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances. Apprenticeship programs must be registered and certified with the Secretary of Labor under the National Apprenticeship Act.↩

You may request a withdrawal via your account online. Select the beneficiary you would like to withdraw the money for, click "Make a Withdrawal" on the left-hand navigation and follow the directions. You may also request a withdrawal using the Withdrawal Request Form.

The beneficiary must be enrolled at least half-time at an eligible postsecondary institution. For students living in housing owned and operated by the institution, the full invoice amount will be used to determine the qualified housing and food expenses. In the case of students living at home or in off-campus housing, the "cost of attendance" allowance for the individual institution will be used for the qualified room and board expenses.

Computers and related technology such as internet access fees, software or printers are also qualified education expenses. The student must be the primary user of the equipment.

Federal tax treatment of a 529 plan's qualified higher education expenses (QHEEs) includes the repayment of up to $10,000 (including principal and interest) on any qualified education loan of either a 529 plan designated beneficiary or a sibling of the designated beneficiary. To be a qualified expense, the loan repayment amount for an individual is subject to a lifetime limit of $10,000.1 Get additional details in the Plan Description.

Footnotes

- 1Withdrawals for tuition expenses at a public, private or religious elementary, middle, or high school, registered apprenticeship programs, and student loans can be withdrawn free from federal and Wisconsin income tax. If you are not a Wisconsin taxpayer, these withdrawals may include recapture of tax deduction, state income tax as well as penalties. You should talk to a qualified professional about how tax provisions affect your circumstances.↩

A taxable withdrawal will be subject to applicable state and federal income tax on earnings, if any, but will not be subject to the 10% additional federal tax on earnings (the "Additional Tax").

Some examples of a taxable withdrawal include a beneficiary's death, permanent disability, receipt of a scholarship award or attendance at a military academy. For more information, review the Plan Description.

Taxable withdrawals that are not subject to the 10% federal penalty tax are withdrawals due to the beneficiary's death, the permanent disability of the beneficiary, the beneficiary's receipt of a scholarship award or certain other tax-free amounts, or the beneficiary's attendance at a military academy. A taxable withdrawal will be subject to applicable state and federal income tax on earnings, if any.

Yes. Funds may be redeposited to your account within 60 days of the refund without penalty should a student need to withdraw from a class. The recontributed amount cannot exceed the amount of the refund.

The SECURE 2.0 Act of 2022, which included several significant retirement savings related enhancements, amended Section 529 of the Internal Revenue Code to allow for funds in long-term 529 plan accounts to be rolled over directly to a Roth IRA for the benefit of the 529 account beneficiary. For the rollover to be treated as a non-taxable event, certain conditions apply as referenced in Am I eligible to rollover funds from my 529 plan account to a Roth IRA?

Account owners may roll money from an Edvest 529 account to a Roth IRA for the benefit of the 529 plan account beneficiary without incurring federal income tax or penalties (state tax treatment varies). For Wisconsin taxpayers, a rollover from a 529 plan account to a Roth IRA is permitted without incurring Wisconsin income tax or penalties.

For the rollover to be treated as a non-taxable event, the following conditions apply:

- The 529 plan account must be open for 15 or more years, ending with the date of the rollover;

- Contributions and associated earnings that you transfer to the Roth IRA must be in the 529 plan account for more than five (5) years, ending with the date of the rollover;

- The Internal Revenue Code permits a lifetime maximum amount of $35,000 per designated beneficiary to be rolled over from 529 plan accounts to Roth IRAs;

- 529 plan assets can only be rolled over into a Roth IRA maintained for the benefit of the designated beneficiary on the 529 plan account;

- 529 plan assets must be sent directly to the Roth IRA;

- Roth IRA income limitations are waived for 529 plan rollovers to Roth IRAs; and

- The Roth IRA contribution is subject to the Roth IRA contribution limit for the taxable year applicable to the designated beneficiary for all individual retirement plans maintained for the benefit of the designated beneficiary.

State tax treatment of a rollover from a 529 plan into a Roth IRA is determined by the state where you file state income tax. Account Owners and Beneficiaries should consult with a qualified tax professional before rolling over funds from their 529 plan to contribute to a Roth IRA. You are responsible for determining the eligibility of a 529 plan to Roth IRA rollover including tracking and documenting the length of time the 529 plan account has been opened and the amount of assets in your 529 plan account eligible to be rolled into a Roth IRA.

For more information, check out this article - Rolling Unused Edvest 529 Savings to a Roth IRA.

Beneficiaries

Anyone with a valid Social Security Number or Taxpayer Identification Number can be the beneficiary, including the account owner. Learn more about who can open, benefit from and contribute to an Edvest 529 account.

There's no cost associated with opening an Edvest 529 account or owning more than one account. You could open a different account for each child.

You might do this to align investment strategies with the time frame each child will begin using the funds. For example, an older child's account could be more conservatively invested to help protect your contributions as they near college, whereas a younger child's account might be invested to balance growth and income strategies during a longer time frame. You may also prefer to pay college expenses first out of your highest growth account to maximize federal tax benefits and to encourage gift contributions from friends and family.

Keep in mind: Edvest 529 allows you the flexibility to select multiple investment portfolios within each account. This offers you more control to manage risk on your terms. For example, adding the Principal Plus Interest Investment Portfolio can help preserve your funds until your student is ready for the next step in their education.

Multiple accounts can also aid in estate planning by ensuring that college funds are allocated appropriately to each beneficiary upon the death of the account owner. But if you'd like to stick to one account, you can change beneficiaries at any time and at no additional cost.

Yes. A beneficiary may have more than one Edvest 529 account. However, an account owner can have only one account for each beneficiary.

For example, a beneficiary may have an account owned by their parent and/or grandparent and/or aunt, etc. There is an overall maximum account balance limit of $589,650, which applies to all accounts opened for a beneficiary.

Yes. You can change the beneficiary of your account at any time or transfer a portion of your investment to a different eligible beneficiary. The new beneficiary must be an eligible member of the previous beneficiary's family.

For more information, read the form on how to change your beneficiary.

Edvest 529 investment portfolios

Performance data for Edvest 529 Investment Portfolios is available.

Edvest 529 offers a wide range of investment portfolios to fit your life situation, risk tolerance and savings goals. These portfolios vary in investment strategy and degree of risk, allowing you to select a portfolio or combination of portfolios that fit your needs and savings goals.

To compare our Edvest 529 Investment Portfolios, visit our Investment Comparison page. For more information on the investment objectives, risks, charges and expenses, read the Plan Description.

Yes. Each time you make a contribution, you may select from any of the Edvest 529 Investment Portfolios. Once invested in a particular portfolio, contributions and earnings may be transferred to another investment portfolio twice per calendar year or upon transfer of funds to a plan account for a different eligible beneficiary (see the Plan Description for more information).

To transfer funds between investment portfolios, log in to your account, click "View Details" for your beneficiary, then choose "Change of Investment Form." You may also request and submit by mail the Change of Investment Form.

Contributions and Gifting

An Edvest 529 account can be started with as little as $25. How much you need to save will depend on what you plan to use the money for and when.

A few helpful tools:

- Check out the College Savings Calculator to estimate the cost of college.

- Use our College Planning Calculator to see how your savings could add up over time.

You can contribute to an Edvest 529 account by any of the following: check, electronic funds transfer, establishing a recurring contribution, establishing payroll direct deposit, rollover from another state's 529 plan account, or redemption proceeds from a Coverdell Education Savings Account or qualified U.S. savings bond. Your contribution will be invested according to your allocation instructions, which you may change at any time online, by telephone or by requesting and submitting the Change of Investment Form. For more information, click here.

Contributing to an existing Edvest 529 account is easy and secure with our online Ugift® platform. Gift contributions can also be made by check and mailed in. Wisconsin taxpayers' gifts may be eligible for the state tax deduction. Check with your tax professional.

For the tax year 2024:

- There's no federal gift tax on contributions you make up to $18,000 per year if you're a single filer or $36,000 if you're a married couple.

- You can also accelerate your gifting with a lump-sum gift of $90,000 if you're a single filer or $180,000 if you're married and prorate the gift over five years per the federal gift tax exclusion.

- You can gift this amount to as many individuals or beneficiaries as you like, free from income tax.

Consult your tax professional for more details. Learn more about gifting here.

To view your transaction history, log in to your account, click "View Details" for your beneficiary and scroll down to the transactions section. You can always speak to one of our college savings specialists at 1-888-338-3789, Monday through Friday, 7 a.m. to 9 p.m. CT.

Wisconsin's maximum 529 plan contribution limit is $589,650 as the sum of all Wisconsin 529 plan accounts for the same beneficiary (i.e., Edvest 529 plus Tomorrow's Scholar, the state's advisor-sold plan). This amount is effective as of January 1, 2025. No contribution may be made to an account if the contribution would cause the account balance of a beneficiary's account, or the combined balance of all accounts of a beneficiary, to exceed the current maximum account contribution limit.

Edvest 529 accounts can be opened with as little as $25. Check out our unique gifting feature to see how you can easily and securely ask for and manage gift contributions to your Edvest 529 account.

Yes. Once an Edvest 529 account is open, anyone can make contributions, not just the account owner. Parents, grandparents, aunts, and uncles, and even family friends can make ongoing contributions to an account, or gift contributions during special occasions like birthdays and holidays. It is easy for friends and family to give a meaningful gift with Edvest 529's Ugift® platform.

Financial aid and scholarships

Assets in a parent-owned 529 account have less of an impact on financial aid than some other savings methods. Expected Family Contribution (EFC) calculations for financial aid generally factor parent assets outside of retirement savings at approximately 5%, whereas student assets are generally factored in at 20% or more. Therefore, a parent-owned 529 account may have less of an impact on financial aid eligibility than assets owned by the student.1

Footnotes

- 1The treatment of investments in a 529 savings plan varies by school. Assets are typically treated as the account holder's and not the student's. (Student assets are generally assessed at 20% whereas parental assets are generally assessed at 5.6%.) Any investments, including those in 529 accounts, may affect the student's eligibility to get financial aid based on need. You should check with the schools you are considering regarding this issue.↩

If the beneficiary receives a scholarship that covers the cost of qualified expenses, you can withdraw the funds from your account up to the amount of the scholarship without incurring the 10% federal tax penalty on the earnings portion. However, the earnings portion will be subject to federal and state income tax. If the amount withdrawn exceeds the amount of the scholarship, the earnings portion of the amount withdrawn will be subject to the additional 10% federal penalty tax. Please consult with a qualified tax professional or consultant.

Historically, withdrawals from grandparent-owned 529 plans have been considered untaxed income to the student and added to the student's adjusted gross income on the FAFSA. Beginning with the 2024-2025 FAFSA, withdrawals from grandparent-owned 529 plans will no longer need to be reported on the FAFSA or negatively affect the student's eligibility for federal financial aid. FAFSA simplification is subject to change. You should check with the schools you are considering regarding this issue. For assistance or help completing FAFSA click here.

Opening an account

Anyone with a valid Social Security Number or Taxpayer Identification Number can open an Edvest 529 account. Accounts can be opened online or by downloading enrollment materials.

There are no sales charges, startup fees or maintenance fees associated with Edvest 529 accounts. For details on total annual asset-based fees, comprised of the underlying investment expenses for each investment portfolio and the plan manager fee, review the Investment Portfolio Fee Table in the Plan Description.

Yes. Whether you have recently moved to the state, have an underperforming or higher-cost 529 plan or just want to simplify, consolidating 529 accounts into Edvest 529 is easy. You can transfer funds from another 529 plan to your Edvest 529 account for the same beneficiary once within a 12-month period without incurring tax penalties.

Consolidating education savings into Edvest 529 also gives you a single view of your savings and performance as well as single-step payments to colleges, universities, etc.

You may also save money that can go right back into your college fund. Edvest 529 expenses are among the lowest in the country and less than half the national average for 529 plans.1 You pay no sales charges, startup fees or maintenance fees.

The 529 plan from which you are transferring funds may be subject to different features, costs and surrender charges. As such, you should consult your tax advisor or the other 529 college savings plan prior to making any decisions. For more information, see how to manage an incoming rollover from another 529 saving plan account.

Footnotes

- 1Source: ISS Market Intelligence 529 College Savings Fee Analysis 3Q 2024. Edvest 529's average annual asset-based fees are 0.15% for all portfolios compared to 0.51% for all 529 plans, 0.86% for advisor-sold plans, and 0.34% for direct-sold plans.↩

Log in to sign up for electronic delivery for statements, transactions, profile confirmations and tax forms.

For information, please click here.

What’s next?

-

A plan for everyone

Almost everyone is welcome to open, benefit from, or contribute to an Edvest 529.

Get the details -

Compare investment portfolios

We make it easy to choose investment portfolios that fit your financial needs and savings goals.

Discover your options -

Ready to get started?

Open an Account